Fundamental Parameter Estimation II: MINIMUM VARIANCE PORTFOLIOS

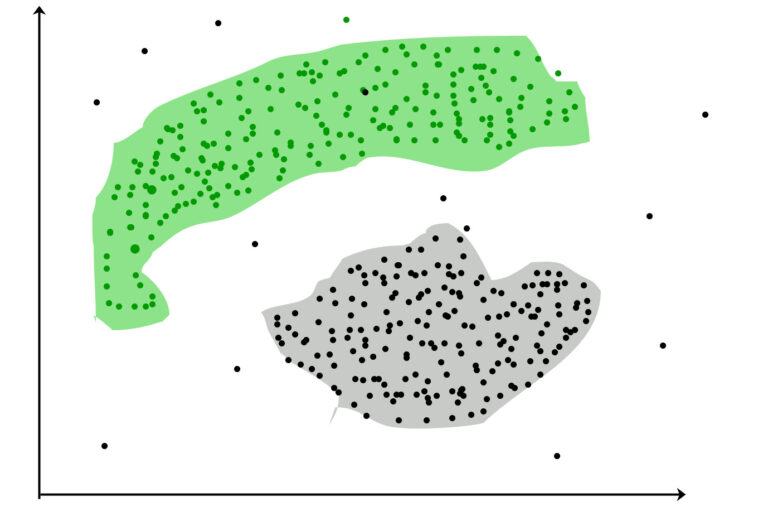

In my last post I introduced Fundamental Return Moment Estimation. This short post applies the resulting estimates to build superior minimum variance portfolios. Both standard mean-variance-, as well as minimum variance portfolio optimization suffer from...

Continue reading